Western speculators packing into gold in the pandemic are more than compensating for a breakdown sought after for physical metal from conventional retail purchasers in China and India, helping push costs to an eight-year high.

Inflows into trade exchanged finances this year – – for the most part in North America and Europe – – are as of now inches from the yearly record set in 2009, as per information accumulated by Bloomberg. In the interim, request in China and India, the world’s two greatest purchasers of gold bars, coins and adornments, plunged after the coronavirus slowed down imports and purged shopping centers. Deals have been delayed to return as rising costs deflect purchasers.

The move underscores the worldwide push-and-pull for gold between western financial specialists searching for a place of refuge and customary interest communities for physical gold in Asia. It likewise brings up pivotal issues for the market this year, as gold costs chance losing support if ETF inflows delayed down, or could increase much more energy if Chinese and Indian interest ricochets back.

“We anticipate the U.S. also, European speculators to stay keen on gold paying little heed to Asian interest,” said Darwei Kung, head of products and portfolio chief at DWS Investment Management Americas Inc. “In the event that the purchasing behavior were to go up also for China and India simultaneously as what you find in the ETF advertise, at that point the cost would have come up considerably further.”

Dread driven speculation request in created nations has contributed about 18% to the current year’s benefit in gold costs, while more vulnerable purchasing by developing business sector shoppers gave a 8% drag, Goldman Sachs Group Inc. evaluated in a June note. A financial recuperation and a more vulnerable dollar may mean developing business sector request in the second 50% of the year could “move from being a delay gold costs to a tailwind.”

In any case, higher gold costs could worsen “request pulverization” in the East and make costs much progressively subject to financial specialists in the West, said Commerzbank AG investigator Carsten Fritsch.

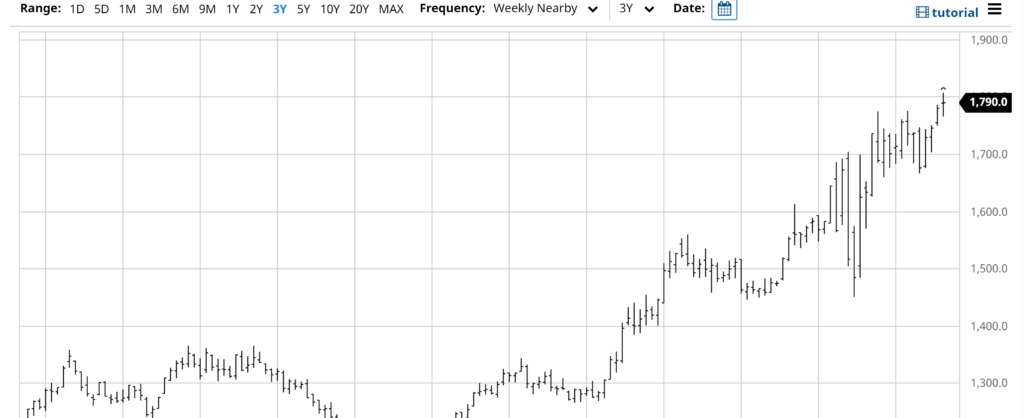

Spot gold has risen 17% in 2020, finishing off the second quarter with the biggest meeting in over four years. On Tuesday, gold futures on the Comex bested $1,800 an ounce just because since 2011.

The more significant expenses have chillingly affected Asian customers even as economies revive. Customarily observed as a store of riches, interest for adornments in China and India tumbled as lockdowns, work misfortunes and feeble monetary development checked optional spending.

Valuable metals consultancy Metals Focus Ltd. gauges a 23% decrease for Chinese gold gems utilization in 2020, while Indian interest is relied upon to drop 36%. Chinese gold deals could be as much as 30% lower than 2019, said China Gold Association Chief Executive Officer Zhang Yongtao. All things considered, that is an improvement from a past gauge of a half decrease when the episode was at its pinnacle he said.

Nidhi Saxena, 31, a software engineer at an innovation firm situated in Gurugram, India, was intending to purchase gold bangles in March, however adjusted her perspective as gold costs took off and associates were laid off.

“I can’t consider purchasing gold right now when I am not even sure if my activity is protected,” she said.

Exchange streams have additionally been influenced. In India, which imports practically all the gold it devours, imports dropped by about 99% in April and May.

On the other hand, request from ETFs has flooded as stresses over the monetary viewpoint, negative genuine rates and cash corruption after monstrous worldwide improvement estimates drove asylum looking for financial specialists into gold.

Absolute possessions of physical gold in ETFs have ascended by in excess of 600 tons this year, as per information ordered by Bloomberg, and ETF inflows outperformed retail buys in China and India in the main quarter just because since 2009. While shopper information isn’t accessible yet for the subsequent quarter, ETF purchasing expanded during the three months to June.

“The interest for gold in 2020 has been only upheld by speculation request,” said Steve Dunn, head of ETFs at Aberdeen Standard Investments. “Streams are charging ahead at an uncommon pace.”

All things considered, ETF purchasing just speaks to one piece of the current year’s sensational progressions of bullion from East to West – an inversion from the run of the mill bearing in progressively typical occasions. In excess of 700 metric huge amounts of gold have been added to vaults around New York this year, the most in records returning to 1993.

The huge imports into the U.S. were expected to some degree to a scramble for gold among New York dealers after the market was overturned as infection lockdowns grounded planes and shut processing plants. Comex inventories have since flooded to a record.

It’s not the first run through venture interest for gold has flooded during a time of worldwide vulnerability, boosting costs and discouraging Asian customers. However it’s indistinct what job waiting coronavirus concerns may play. During the worldwide budgetary emergency, customer purchasing in China and India bounced back from lows inside a year yet it took until 2013 – and a droop in costs – for consolidated interest in the district to hit the most elevated in 10 years.

“Unquestionably we see that this year, the retail business will be very testing, particularly for the adornments segment,” said Roland Wang, overseeing executive for China at the World Gold Council. A bounce back popular will rely upon the financial and pandemic circumstance, he said.