GOLD PRICES fell close to 2-week lows on Tuesday, dropping over $20 to contact $1661 per ounce as swelling desires sank after US raw petroleum costs plunged underneath zero just because on record.

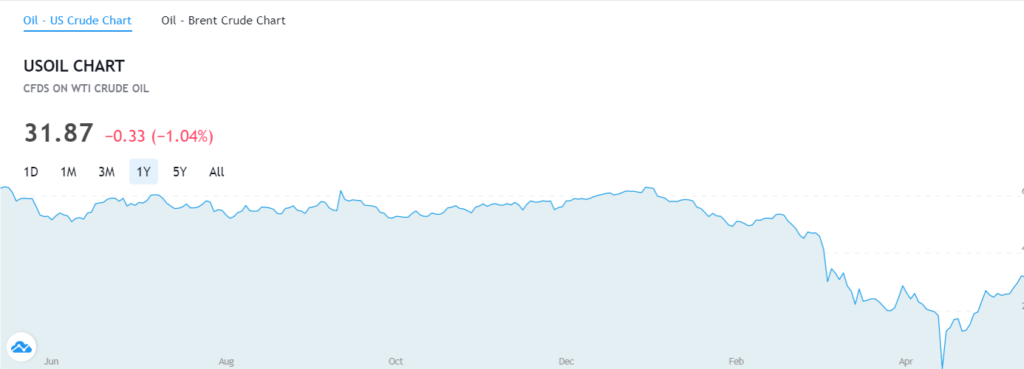

With North American storerooms coming up short on space in the midst of the declining Covid Crisis financial downturn, oil makers were adequately offering to pay purchasers of Nymex May raw petroleum fates around $5 per barrel by New York’s initial today, the agreement’s last day of exchanging.

The May contract plunged to short $40 overnight – down from almost +$18 at Monday’s open – while costs for June, presently the ‘front month’ contract, today fell by one fifth to under +$17 per barrel.

Asian securities exchanges lost over 2% on normal interim, and European values lost around 3%, as the Reuters/Jeffries CRB file of characteristic assets sank nearly 7% for the afternoon.

Significant government security costs rose as items and financial exchanges fell, pulling the yearly yield offered by 5-year US Treasury securities down to 0.31% per annum.

Swelling desires fell quicker nonetheless, with 5-year US breakeven rates dropping from 0.67% per annum at Friday’s near 0.50% by Tuesday’s New York opening.

Together, that pulled the genuine pace of enthusiasm on 5-year US Treasury obligation up from – 0.31% to – 0.18% per annum, the least negative so far in April and strongly above early March’s 7-year low of – 0.56%.

Gold costs show an unmistakable and progressively solid opposite relationship with genuine loan fees, moving higher as they move lower (and the other way around).

On a factual premise, the moving 52-week connection of Dollar gold costs with 5-year expansion balanced Treasury security yields shows a normal r-squared of 84% so far in 2020, up from 46% over the earlier 15 years.

Finding altogether more interest from industry than gold, silver fell harder on Tuesday, dropping 3.7% to $14.80 per ounce, some $3 above a month ago’s abrupt 11-year lows.

Platinum costs fell more diligently as yet, dropping 7.0% to $725 per ounce – some $150 above a month ago’s infection emergency plunge to 2002 levels.

Mechanical use overwhelms platinum’s yearly off-take, with about 40% of the metal’s end-utilize originating from automakers requiring diesel-motor impetuses.

Sister metal palladium – down 14.4% on Tuesday after raw petroleum’s dive – discovers 85% of its interest from fuel autocats.

In front of gold’s value drop, Shanghai costs slice their markdown to London statements to $47 per ounce, recommending a superior interest/gracefully balance after gold in China – the metal’s No.1 shopper advertise – sank to unsurpassed record limits of $72 last Friday.

Discount gold estimated in the Euro today tumbled to 1-week lows underneath €1540 per ounce – another unsurpassed when previously came to in February.

The UK gold cost in Pounds per ounce was minimal changed above £1355, another record when originally came to in March, as Sterling tumbled to 2-week lows versus the Dollar on the money advertise.

Passings over the world’s fifth biggest national economy are running at twice their run of the mill level for this season of time, with a lot more passings outside of medical clinic liable to stay unrecorded in the official UK information up until this point.