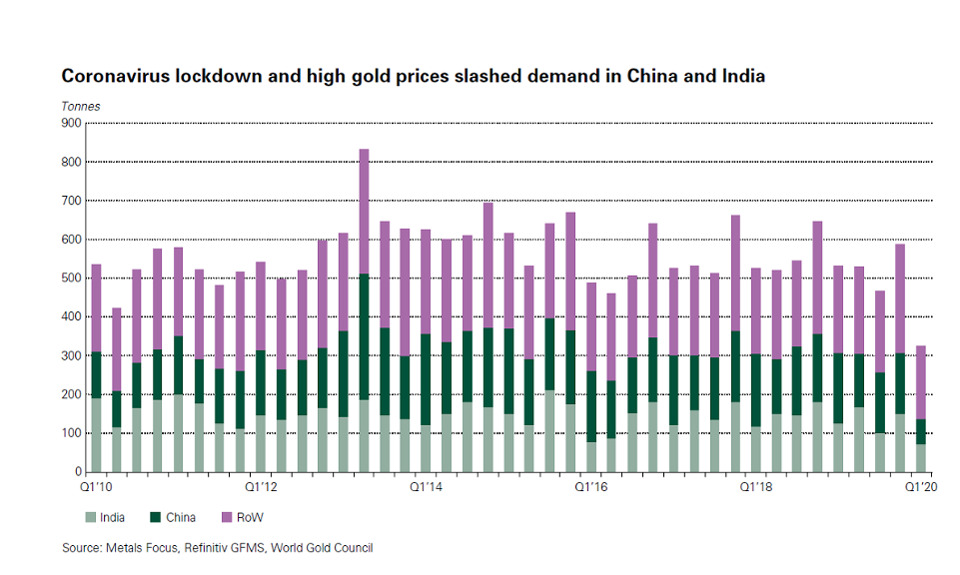

The worldwide novel coronavirus pandemic has caused first quarter year-on-year interest for gold gems to fall by 39% to 325.8 tons, a record low for the quarterly Global Demand Trends report by the World Gold Council (WGC). Rising costs for the valuable metal energized by place of refuge venture, and a covered retail and assembling condition were credited with the extreme decrease.

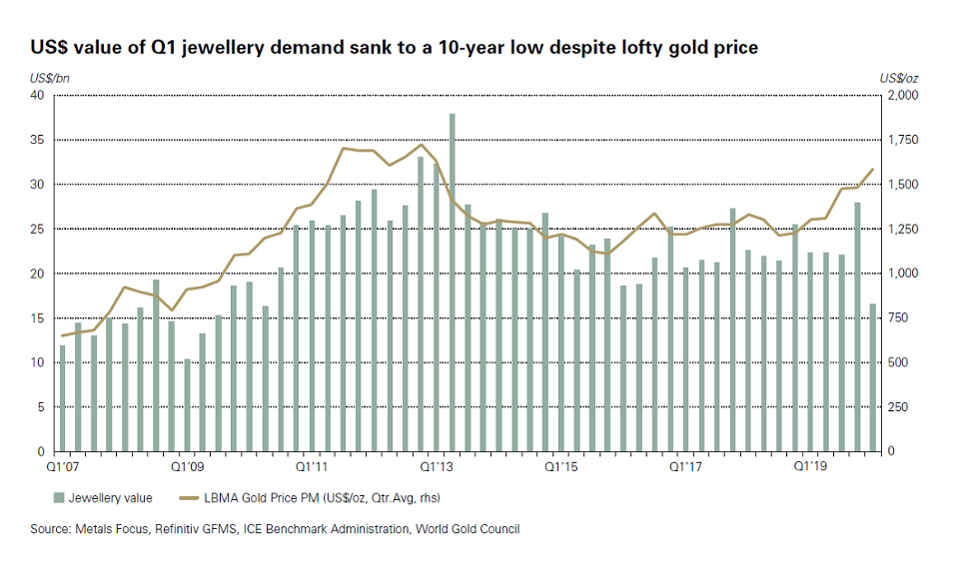

In esteem terms, worldwide gold gems request sank 26%, year-on-year, to $16.6 billion, its most reduced an incentive since the second quarter of 2010 in the result of the Global Financial Crisis, WGC said in its report discharged Thursday. This drop happened regardless of a quarterly normal gold cost of $1,582.8 per ounce.

“Nearly regardless, adornments showcases over the globe recorded y-o-y misfortunes as the effect of the coronavirus intensified the impact of high, and steeply rising, gold costs,” the WGC said in its report.

China

The hardest hit nation by a long shot was China, the world’s biggest gems showcase, as first quarter request plunged by 65%, year-on-year, to 64 tons, its least level in over 13 years.

“The most noteworthy quarterly normal Shanghai Gold Exchange (SGE) gold cost at any point, joined with shoppers’ financial plans being restricted by across the board lockdowns, additionally caused significant damage – cost and buyer consumption being two key essential drivers of China’s gems request,” the WGC said.

With the nation in lockdown, shopping centers were shut and purchaser spending was decreased to necessities. In any case, the WGC said diamond setters moved online to sell merchandise, which the report refers to as a “silver coating” for the gems showcase. What’s more, neighborhood governments and huge adornments retailers attempted to reenact spending. For instance, in March, numerous urban areas gave out e-vouchers to support relaxation spending on exercises, for example, eating and shopping. Adornments retail chain, Chow Tai Fook, offered limits on a scope of items to additionally bolster deals.

India

Gems request fell 41%, year-on-year, to a 11-year low of 73.9 tons as COVID-19 exacerbated the effect of higher household gold costs in the midst of a devaluing money and milder monetary development, the WGC said.

The wedding season lifted interest right off the bat in the quarter. Be that as it may, a sharp increment in nearby gold costs from mid-February prompted a stoppage sought after as customers kept down on buys. In March, gems request drooped by 60% to 80% because of a countrywide lockdown, the WGC said. By March the cost of gold in India arrived at notable highs.

“While Q1 request was hard hit, we expect the effect of COVID-19 to be progressively extreme in the subsequent quarter, as the lockdown reaches out into May,” the WGC says in its report. “This will affect gold interest during the key purchasing celebration of Akshaya Tritiya, just as wedding-related buys. Albeit some marked retailers have revealed expanded enthusiasm for their online stages, calculated issues forced by lockdown measures have made it hard to satisfy the requests they produce.”

U.S. what’s more, Europe

The U.S. recorded its first year-on-year decrease in adornments request since the final quarter of 2016 as request slipped 3.7% to 23.1 tons on account of the infection.

“After additions in January and February, request fell forcefully in March as state-level limitations set off the downturn,” the WGC said. “By quarter-end, a great part of the US was under some level of limitation. The ensuing bounce in joblessness and alert towards optional spending just amplified the effect on request. While there was some pay from development in online interest, the volume of deals being made by means of this channel is as of now too little to even consider making a prominent effect.”

In Europe twofold digit decreases were basic over the locale. First quarter request fell 15% to a record low of 10.8 tons. Misfortunes were generally articulated in Italy (- 22% year-on-year), one of the nations most exceedingly awful hit by the pandemic on the mainland, and the United Kingdom (- 20% year-on-year). Retail deals in the U.K. were at that point frail in January and February before COVID-19 hit the market in March, as indicated by the report. Before the finish of the quarter, every one of the four hallmarking workplaces had shut without precedent for history.

Center East and Turkey

Turkish adornments utilization in the main quarter fell by 10%, year-on-year, to 8.6 tons, despite the fact that WGC said the nation indicated versatility as neighborhood gold costs hit new highs as customers bought 22K gold gems as a place of refuge. “Notwithstanding, the Q2 standpoint is negative as the administration forced lockdowns in April, which have shut by far most of gems stores,” the WGC said.

Adornments request in the Middle East was down 9%, year-on-year, to 42.9 tons as business sectors over the locale were upset by coronavirus. Iran, which was hit prior and all the more seriously by the infection, saw a 20% decrease popular to 7.7 tons. The report depicted Egypt as an anomaly as its interest was unaltered year-on-year at 6.9 tons.

“In spite of the progressing pandemic, Egypt chose not to embrace an all out lockdown and this protected the market from the misfortunes continued over the remainder of the locale,” the WGC said. “The viewpoint for Q2 is more negative, be that as it may, as the monetary effect of the district’s lockdown is required to grab hold.”

Other Asian Markets

The littler Asian markets all supported twofold digit misfortunes in the primary quarter, with cost driven shortcoming offering path to the effect of coronavirus. Indonesia (- 55%) and Thailand (- 45%) were by a wide margin the hardest hit markets. Japan was moderately strong, with year-on-year misfortunes down 10% to 3.1 tons. Request was unobtrusively lower at 3.1 tons as not many limitations were forced during the period. Nonetheless, the WGC is less idealistic for the subsequent quarter as Prime Minister Shinzo Abe announced a highly sensitive situation in April as the quantity of COVID-19 cases rose forcefully.

Speculators rush to gold-supported ETFs

Generally, gold interest developed by 1% to 1,083.8 tons. The WGC acknowledged the coronavirus flare-up as “the single greatest factor affecting gold interest. As the size of the pandemic – and its expected monetary effect – began to develop, financial specialists looked for place of refuge resources.”

Gold-sponsored Exchange-Traded Fund (ETFs) pulled in enormous interest from financial specialists expanding by 298 tons, which pushed worldwide possessions in these items to another record high of 3,185 tons. All out bar and coin speculation fell 6% year-on-year to 241.6 tons as a 19% drop in bar request to 150.4 tons overwhelmed a sharp bounce popular for gold coins, up 36% to 76.9 tons, because of place of refuge purchasing by Western retail speculators.

Innovation interest for gold fell 8%, arriving at a new low of 73.4 tons. National banks kept on purchasing gold in noteworthy amounts, in spite of the fact that at a lower rate than in the primary quarter of 2019 as net buys declined 8% year-on-year to 145 tons. The infection additionally made interruption gold gracefully as mine creation fell 3% to a five-year low of 795.8 tons.